Review of Microsoft earnings FY23 Q2 (ending 31Dec2022) ~ can the fundamentals outlast the gloomy outlook?

as of 25Jan2023, SGT

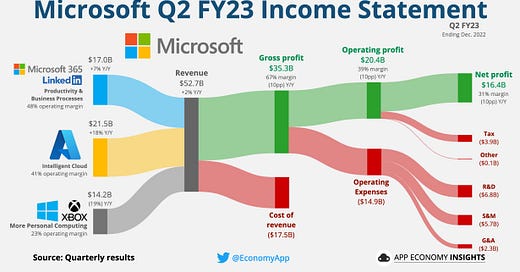

Microsoft’s earnings were released in the after-hours of 24 Jan 2023 as the Big Tech earnings season moved into the next gear. Let us look into the news and financial statements about Microsoft’s earnings in greater details. The graphic of income statement below is an excellent overview done by Twitter user EconomyApp.

From CNBC news:

Earnings: $2.32 per share, adjusted, vs. $2.29 per share as expected by analysts, according to Refinitiv.

Revenue: $52.75 billion, vs. $52.94 billion as expected by analysts, according to Refinitiv.

Microsoft called for $50.5 billion to $51.5 billion in fiscal third quarter revenue, which works out to 3% implied growth, while analysts polled by Refinitiv had expected $52.43 billion.

Source: https://www.cnbc.com/2023/01/24/microsoft-msft-earnings-q2-2023.html?utm_content=Main&utm_medium=Social&utm_source=Twitter#Echobox=1674602532

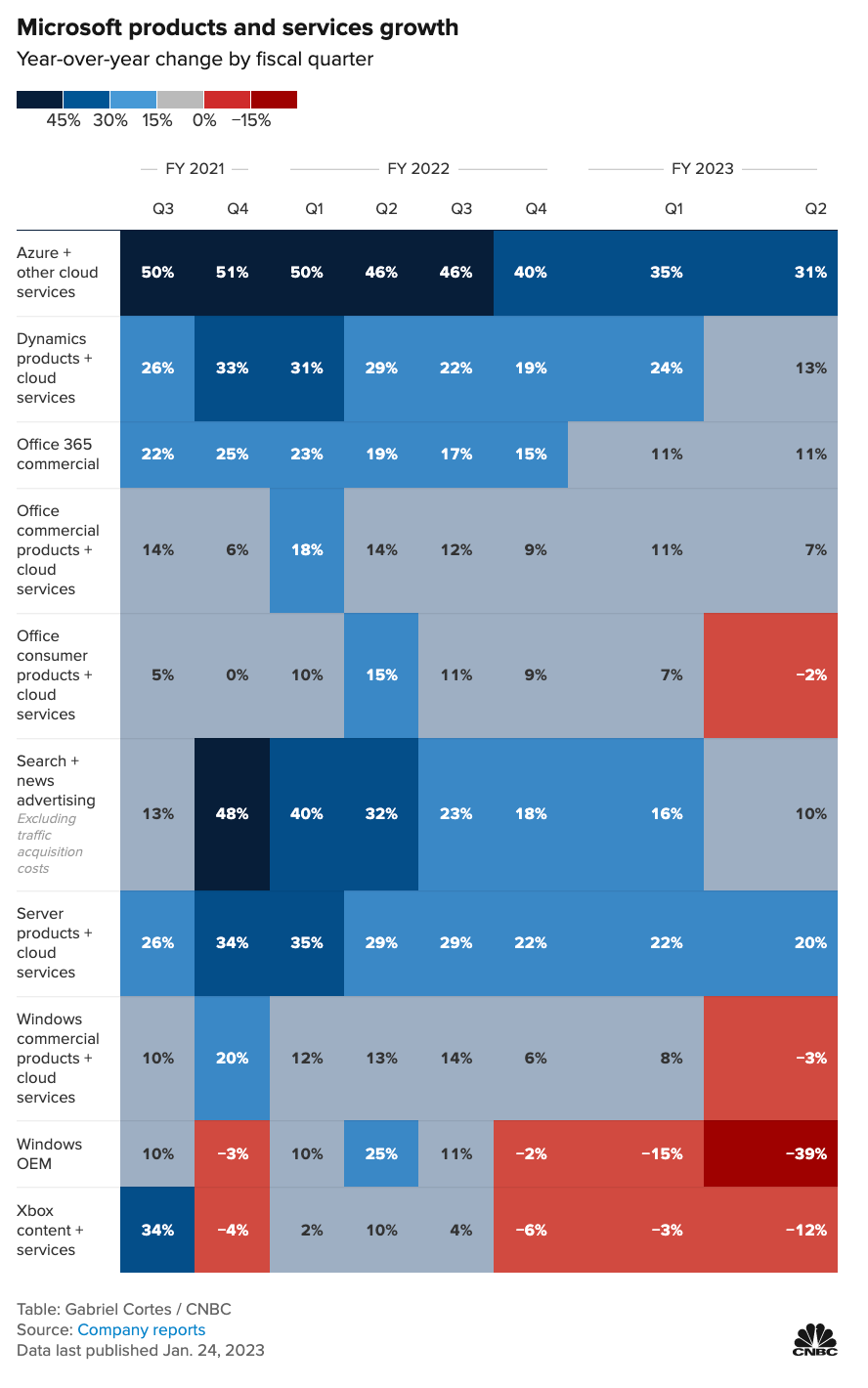

Here is an overview by segments (provided by CNBC via the same link above:

As per the table above, we can see that Microsoft continues to experience growth (YoY change by fiscal quarter) in most segments except for:

Office Consumer products + cloud services (-2%)

Windows Commercial products + cloud services (-3%)

Windows OEM (-39%) - this segment has been in decline for the last 3 quarters

Xbox content + services (-12%) - this segment has been in decline for the last 3 quarters

What is notable is that every segment is experiencing a decline in growth rate with the biggest growth rate coming from the sectors of Azure + other cloud services (31%) and Server products + cloud services (20%). Such a decline is expected over time but it is needful to know how Microsoft performs compared to the competition.

While there is the comfort of revenue growth in most segments, net income is a more critical reference. What is the use of more revenue if we are still losing money? Fortunately, Microsoft has continued to post good revenue and net income in such a climate.

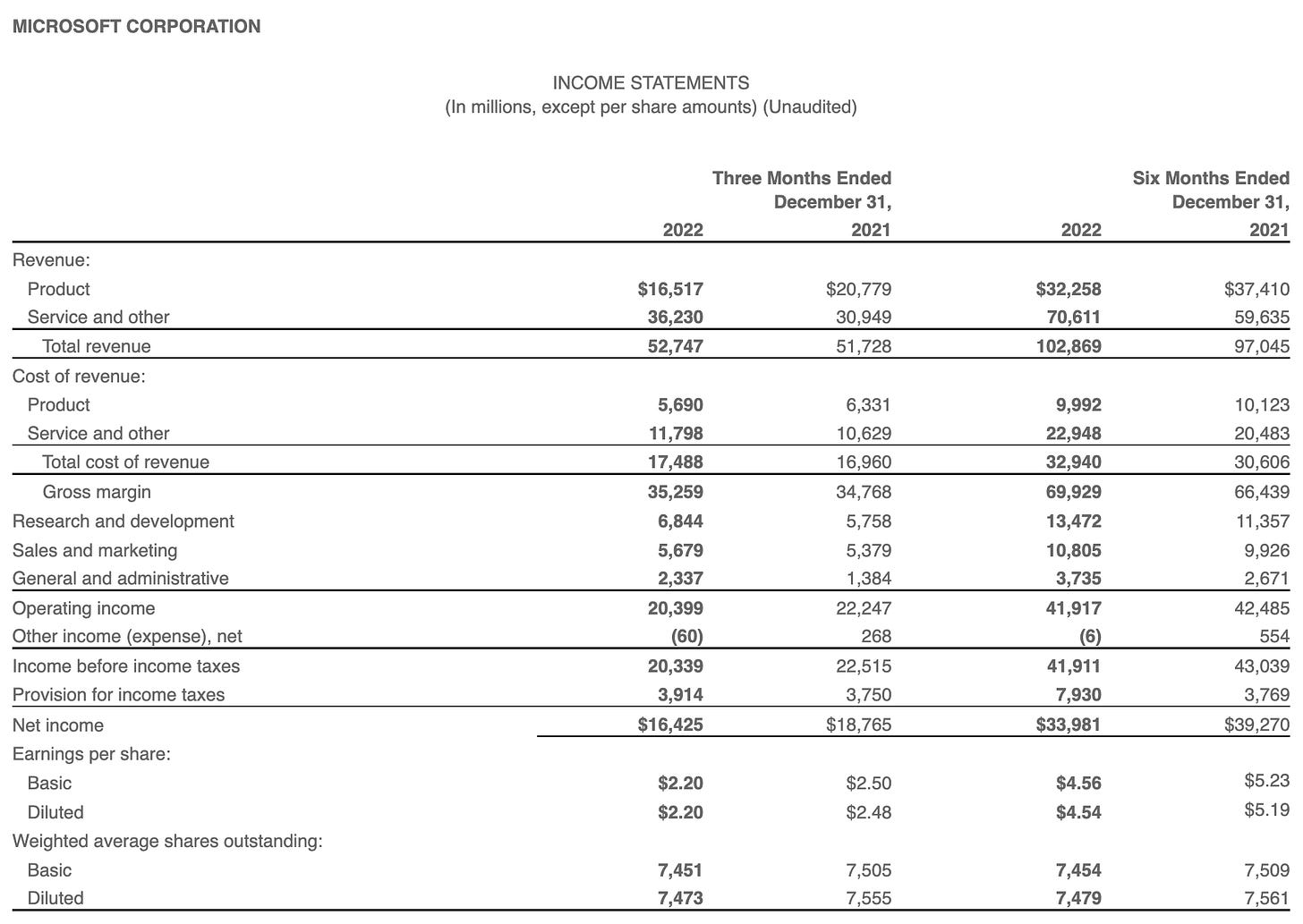

Observations from the income statement (referencing 6 months ended Dec 31, comparing the same period between 2021 and 2022):

Overall revenue growth from $97B to $102B (6%), product segment dropped from $37B to $32B whereas service & others grew from $59B to $70B

The total costs of revenue grew from $30B to 32B (7.63%)

There is concern as the cost of revenue (7.63%) is growing at a faster rate than overall revenue growth (6%).

Expenses breakdown:

Research & development (R&D) costs grew from $11B to $13B (18.62%)

Sales & marketing (S&M) costs grew from $9.9B to $10.8B (8.86%)

General & administrative (G&A) costs grew from $2.6B to $3.7B (39.84%)

The above (total) expenses (R&D, S&M and G&A) grew from $23.9B to $28.0B (an increase of 16.94%)

There is some concern as the expenses (R&D, S&M and G&A) grew at 16.94% compared to the revenue growth of 6%. This is something that they should be managing better. With the recent layoffs, we hope to see some reduction in G&A. Here is the news extract from the same CNBC article above:

The company took a $1.2 billion charge in the quarter in connection with its decision to cut 10,000 jobs, revise its hardware lineup and consolidate leases. The charge includes $800 million in employee severance costs.

Provision for income tax has increased 110.40% from $3.7B to $7.3B. This is quite a substantial doubling.

The resulting net income (after tax) fell from $39B to $33B (-13.47%). While there is still good profit, I have minor concerns as there is a trend of increase costs that exceed that of the revenue growth. Despite the 6% growth in revenue, we see a drop of net income (after tax) of 13.47%.

Thus, the EPS (basic) has dropped 12.81% from 5.23 to 4.56

However, it is encouraging to note that the (Basic) weighted average shares outstanding has dropped 0.73% (partly due to stock buy backs).

Observations about the Balance Sheet (comparing 30 Jun 2022 with 31 Dec 2022):

A drop in total current assets from $169B to $157B (-6.99%). An increase in total long term terms from $195B to $206B (5.93%). Total assets remained almost unchanged with a slight drop of 0.08%

Total cash, cash equivalents and short-term investment amounting to $99.5B is more than adequate to cover the entire total current liabilities of $81.7B. This implies that we should not have any short-term liquidity/cashflow concerns.

A drop in total current liabilities from $95B to $81B (-14.06%). A drop in total long-term liabilities from $103B to $99B (-3.41%). Total liabilities fell 8.51%. This is good as we need more asset accumulation than liabilities.

Retained earnings has increased from $84B to $99B (a handsome 17.90% increase). BDC.CA defines Retained Earnings as the following by BDC.CA:

Retained earnings are the amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders. This represents the portion of the company's equity that can be used, for instance, to invest in new equipment, R&D, and marketing.

Total shareholders’ equities has increased 9.96% from $166B to $183B.

Things look good on the balance sheet.

Observations from the cash flow statements (comparing 6 months ending 31 Dec for calendar years 2021 & 2022):

Net cash from operations fell 11.91% from $39B to $34.3B. Net cash used in financing dropped from -$28B to -$22B (-21.34%) and Net cash used in investing increased from -$4.4B to -$10.2B, a 133% increase.

Stock-based compensation expenses grew 31.43% from $3.5B to $4.7B.

Accounts Receivable grew 73.28% from $4.9B to $8.5B.

Good to see $1.75B paid for repayment of debts. This will reduce the interest incurred in environment of rate hikes.

Despite some stock issue ($818M), it is good to see repurchase of stocks at $11,032M.

However, one area of concern is the Free Cash Flow falling 20.23% from $27.3B to $21.8B

Microsoft’s comments about Outlook from the same CNBC news article above:

Business weakened in December, including in growth of consumption of Azure cloud services, Amy Hood, Microsoft’s finance chief, said on the call. During that month growth in new business was lower than management had expected for Microsoft 365 productivity software subscriptions, Windows Commercial products and Enterprise Mobility and Security offerings, Hood said.

Customers are looking to save money through optimization of existing workloads, and they’re also being more cautious about new workloads, Nadella said.

Hood said she expects Azure cloud growth to slow again in the fiscal third quarter.

Conclusion

While Microsoft has delivered another excellent quarter earnings (ending 31 Dec 2022), we noted drop in revenue growth with a few segments with notable decline. While there is 6% revenue growth, the net income (after tax) has dropped 13.47% (using 6 months ending 31 Dec, comparing 2021 with 2022 using the same period). Before it sounds too negative, a net profit of $33.981B (6 months ending 31Dec022) remains a remarkable achievement. The balance sheet remains robust with good signs of falling liabilities and increasing retained earnings. The FCF has fallen over 20% but remains at a healthy level of $21B. It is good to note the shares buy back and paying down of debts. However, the increasing stock based compensation remains high, growing over 31% (6 months ending 31 Dec) when we compare 2021 with 2022.

Following the earnings, the stock has fallen 1.01% during after hours ending 7.59pm EST. As per the comments made during the earning call, there are concern of market outlook. Microsoft's revenues increased 2% over the last year (when comparing QoQ), the slowest YoY growth rate since Q2 2017. There is genuine concern on growth in the coming months.

While it is heartening to see some costs cutting measures such as retrenchment but the expenses must be brought under better control. Microsoft is also facing some legal challenges and these can curtail their market and reach, pending what measures are taken.

However, Microsoft has made a bold investment into ChatGPT. This has led Google into issuing “code red” concerns internally. There are elements of regulations, content protection, content authencity, copyrights to be worked out for Artificial Intelligence. Many sectors could be disrupted fundamentally. While it is still early in the game, Google’s concerns are not unfounded.

Given the current macro environment, Microsoft’s outlook have raised some concerns. However, Microsoft remains a growing company with good profitability, strong balance sheet and Free Cash Flow at about $21B. The market sentiments and recession could drag Microsoft’s stock prices down but, Microsoft has all the attributes to return stronger and better than most businesses. It maybe a good earnings with gloomy outlook but we can be confident in the fundamentals of the business. It may not be a time to buy into the business but this company should be on our shortlist. Let us research before investing.