Stock review $OXY Occidental - is it still a good buy now that Berkshire bought it recently?

Occidental saw investment from Berkshire. Are we too late to the party if we invest now?

Business Description

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, Africa, and Latin America. The company operates through three segments: Oil and Gas, Chemical, and Marketing and Midstream. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas. Its Chemical segment manufactures and markets basic chemicals, including chlorine, caustic soda, chlorinated organics, potassium chemicals, ethylene dichloride, chlorinated isocyanurates, sodium silicates, and calcium chloride; vinyls comprising vinyl chloride monomer, polyvinyl chloride, and ethylene. The company's Midstream and Marketing segment gathers, processes, transports, stores, purchases, and markets oil, condensate, NGLs, natural gas, carbon dioxide, and power. This segment also trades around its assets consisting of transportation and storage capacity; and invests in entities. Occidental Petroleum Corporation was founded in 1920 and is headquartered in Houston, Texas.

Beta: 2.0512

Share Turnover: 960%

$OXY as of 7.50am EDT 11Apr22

Now, let us do a deep dive into their financials

Overview of OXY

From the above, their 10-Year CAGR for EPS stands at -15.3%, there were 4 years of negative EPS in the last 10 years. This is something of concern.

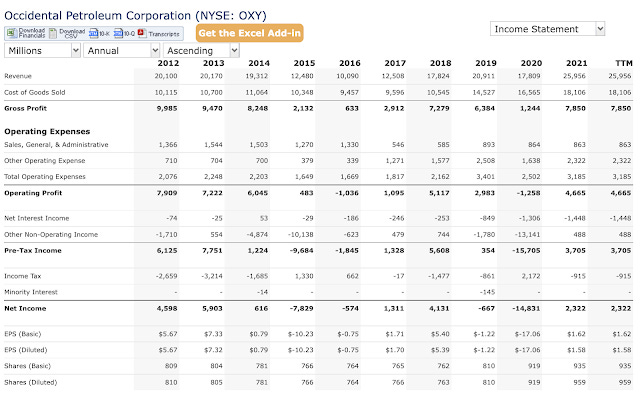

Income statement of $OXY

2021 ended with revenue of $25,956M and a recent Gross Profit record of $7,850M. The resulting operating profit (2021) stood at $4,665M. This is a strong recovery from a loss of $1,258M (2020).

"Other operating expenses" grew from $1,638M (2020) to $2,322M (2021). This is something to be monitored.

We also noted that basic shares grew from 809 million (2012) to 935 million (2021), a 15.5% shares dilution over 10 years. EPS (Basic) grew from a -$17.06 (2020) to $1.62 (2021). It is good to be back in the black. Despite this, there are some concerns with 4 years of negative EPS.

Balance Sheet of $OXY

Total asset value shrank $32B from $107,190M (2019) to $75,036M (2021). Likewise, total liabilities value shrank $18B from $72,958M (2019) to $54,709M (2021). This remains an area of concern as the shrinkage in total assets is much more than that of total liabilities.

Retained earnings increased from $2,996M (2020) to $4,480M (2021). However, there is concern about the drop in Retained earnings from $20,180 (2019) to $2,996M (2020).

Cash flow statement from 2012 to 2021

In 2019, there was an issuance of debt worth $15B to fund the acquisition of Anadarko costing over $28B. This was followed by a net income loss of $14,831M in 2020.

Berkshire bought its preferred stock in 2019 to help finance Occidental's $35.7 billion purchase of Anadarko Petroleum Corp. The preferred stock throws off $800 million of annual dividends. Berkshire also has warrants to buy $5 billion of additional Occidental stock at $59.62 per share.

Thankfully, the cash from operations improved from $3,995M (2020) to $10,434M (2021) as we see some benefits of their acquisition of Anadarko. There was a repayment of debt worth $6,834M (2021). As of 2021, the long term debt stood at $28,927M. This implies that the business will need to continue servicing this long term debt.

1D chart of $OXY as of 11Apr2022

From Reuters News:

March 17 (Reuters) - Occidental Petroleum Corp shares rose on Thursday after Warren Buffett's Berkshire Hathaway Inc (BRKa.N) said it spent nearly $1 billion on additional shares in the oil company, giving it a 14.6% stake.

Berkshire disclosed in a Wednesday night regulatory filing that it owns 136.4 million Occidental shares, including 18.1 million purchased between Monday and Wednesday.

Buffett's company began disclosing this month that it was investing in Occidental common stock, on top of $10 billion in preferred stock it already owned. Berkshire has spent at least $6.4 billion on the common stock, regulatory filings show.

From the Yahoo Finance article:

According to the latest data, Buffett invested over US$4.5b at prices between US$47.07 and US$58.58. Additionally, Berkshire has grants to invest an additional US$5b at a price per share of around US$59.62, as well as 100,000 shares of preferred stock.

The above explained the surge of $OXY in March 2022 when Buffett's investment was announced. A big part of Berkshire's purchase is in preferred stock that pays back 8% per annum per year. Thus, Berkshire is assured of dividend repayment worth $800M per year from $OXY. This is a healthy 8% per annum - which may be treated as a loan. There was $6.4 billion spent on common stock. Berkshire's purchase price is approximately between $47.07 to $58.58 per share. For the 18.1 million purchased from Mon to Wed (14 to 16 March 2022), the price range is between $52.28 to $55.99. This can amount to over $950M.

We can estimate that the "fair value" of the stock is $47 to $58 which usually includes a margin of safety. Thus, entering with the current market price of $58.66 (as of 11Apr2022, 2251 hrs SGT) can be worth considering though it is on the higher end of the value.

Conclusion

Berkshire has dividends worth 8% per annum ($800M), and the gains from the share price have yet to be factored in. $OXY probably foresee the "market interest" generated by Berkshire and sees this as a good "win-win" situation. With Berkshire as an investor, their stock price has gained over 40% since the announcement was made. The last 10 years saw a mixed performance of both profits and losses.

For retail trailers, we do not have access to the preferred stock that gives an annual dividend of 8%. With the investment into Anadarko, we should expect a better trend in profits, FCF and improving debt positions over the coming months. I prefer to have this trend confirmed by their coming earnings before investing. This is an example of why we should not clone blindly cause the deal brokered does not comprise solely of common stocks.

The Ukraine crisis saw a surge in oil prices and thus this sector (with Occidental) has benefitted. Ongoing peace talks have yet to yield assurance of a quick end. The "hype" in energy should be easing with countries developing their alternate energy sources away from Russia. This is seen in crude oil prices approaching $96 per barrel - close to the $92 on 24 Feb 2022 when the conflict first started. Thus, we can expect the stock price to fall together with the oil prices.

For now, I will prefer to be a spectator and not an investor.