Public Holidays

There are no public holidays in China, America, Singapore, or Hong Kong.

Economic Calendar (23Jun25)

Notable Highlights

The most watched economic data is the Core PCE price index. This is the preferred reference used by the Federal Reserve as an inflation indicator for America.. This is likely to bring some volatility. The Core PCE Price Index (YoY) was previously 2.5%. Will President Trump get what he wants with a rate cut? A falling PCE can aid his course.

CB consumer confidence has a forecast of 99.0, a drop from the previous, which suggests declining consumer confidence. Durable Goods orders have previously dropped 6.3%, and if this trend continues, it is bearish for the economic outlook.

The S&P Global Manufacturing PMI has reported a previous index of 52.0. This implies growth from the previous month. S&P Global Services PMI has previously reported 53.7 which implied growth in the services sector.

Existing home sales have been forecasted at 3.95 M, a drop from the previous period. This is something that we use as a reference for the property market that has dwindling sales. New Home sales have a forecast of 700k, a possible drop from the previous number of 743k. It seems that the property sales market is dwindling.

Initial jobless claims will be announced. The previous was 245K. This weekly report tracks the number of new unemployment claims, serving as a leading indicator of labour market health. The Federal Reserve uses this as one of the key macro data references as it balances inflation and employment in the economy.

Crude Oil Inventories can be seen as forward indicators of market demand and consumption. This event tracks the weekly change in U.S. crude oil inventories, a key indicator of oil supply and demand that can impact oil prices and energy markets. If the trend of excess inventories continues, demand erosion can lead to reduced production & weakened consumer spending.

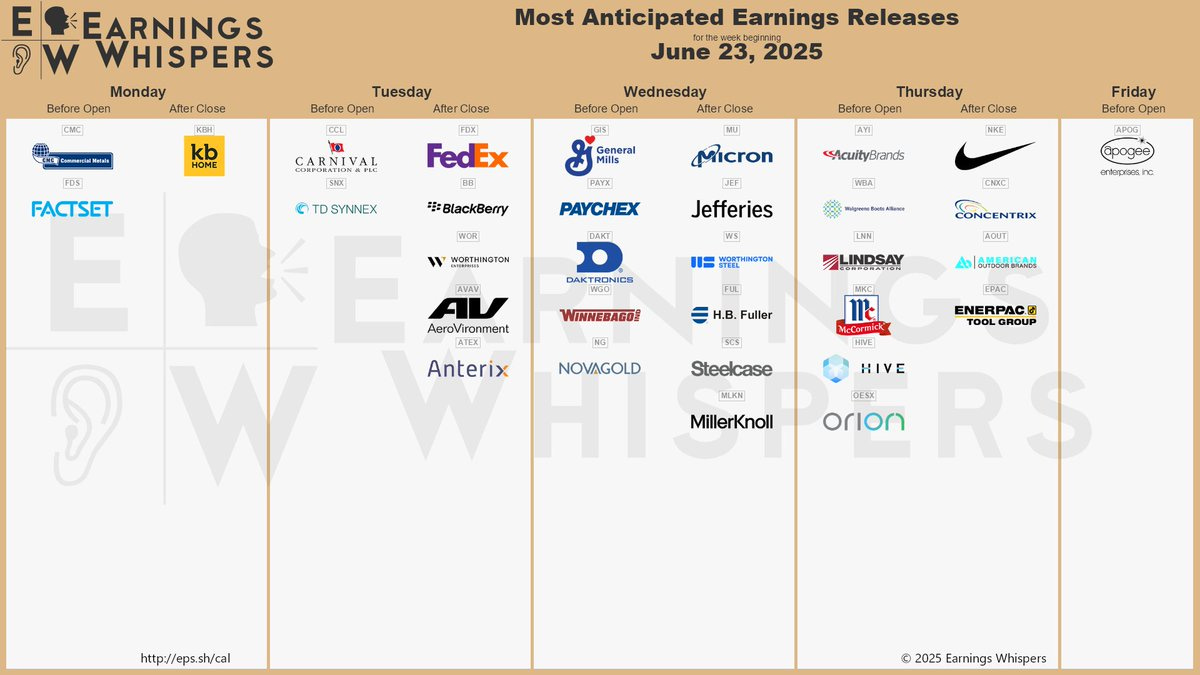

Earnings Calendar (23Jun25)

I am interested in the earnings announcements from Nike, Micron, FactSet and FedEx.

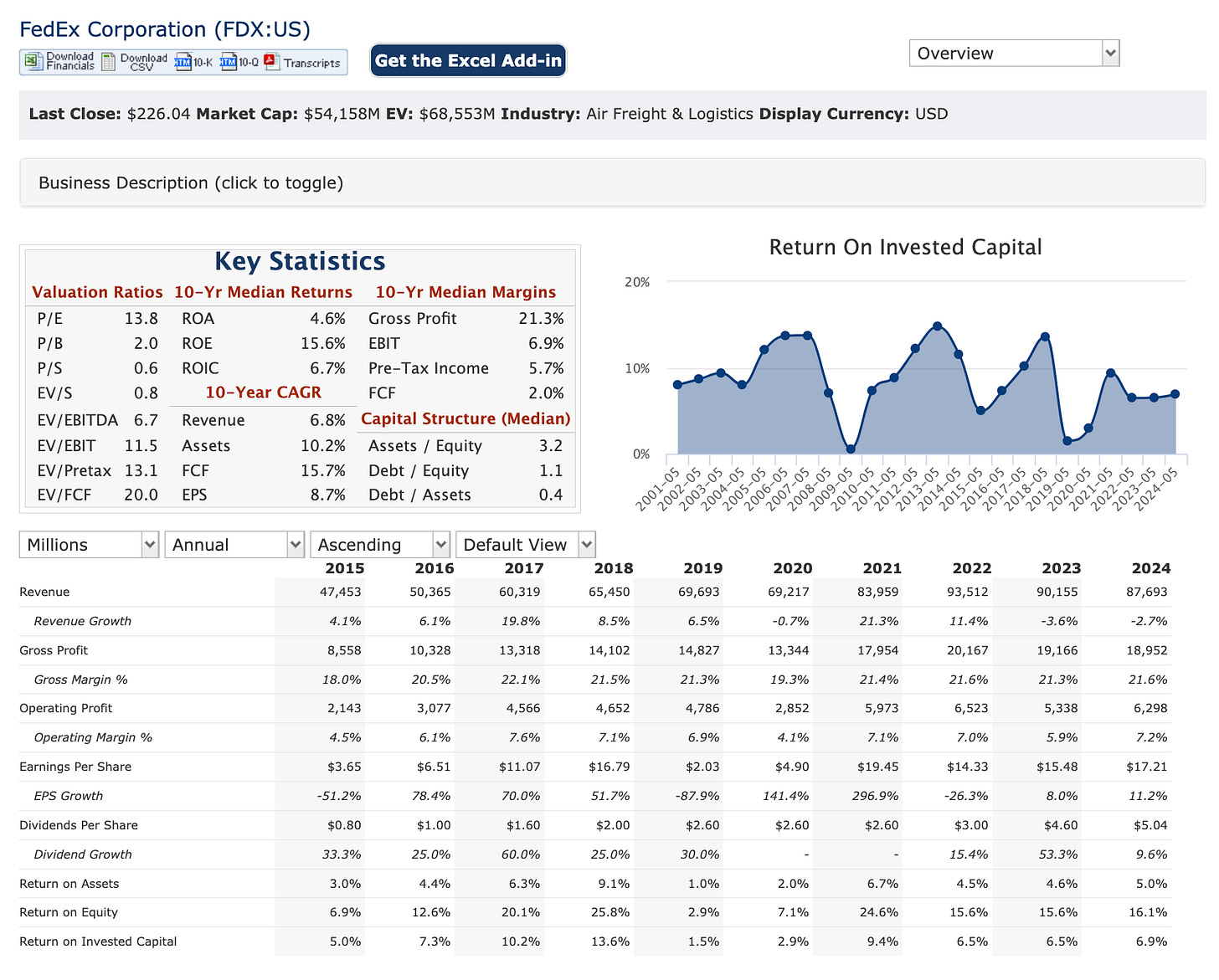

Let us look at the performance of FedEx.

The stock price has fallen 9.0% from a year ago. The Technical Analysis has recommended a “Strong Buy”. From the Analysts’ sentiment, there is a “Buy” recommendation. The price target of $272.16 suggests an upside of 20.41%.

Observations of FedEx’s performance:

The revenue of FedEx has grown from $47.5 billion (2015) to $87.6 billion (2024).

The 10-year median margin of gross profit is at 21.3%.

The 10-year median margin of FCF is 2.0%, but there is a strong 15.7% 10-year CAGR.

Operating profit has grown from $2.1 billion (2015) to $6.2 billion (2024).

Earnings per share grew from $3.65 (2015) to $17.21 (2024).

Dividends per share grew from $0.80 (2015) to $5.04 (2024).

Valuation: The P/E ratio is 14.9, suggesting FedEx is reasonably valued relative to its earnings, aligning with its stable industry position.

10-Year Median Returns: The 10-year median return on assets (ROA) is 4.6%, return on equity (ROE) is 15.6%, and return on invested capital (ROIC) is 6.7%, indicating solid historical returns.

Growth Trend: The EV/FCF ratio is 27.4, and the 10-year CAGR for FCF is approximately 15.7%, reflecting strong cash flow growth. The 10-year median FCF margin is not specified but implied to be positive.

Capital Structure: The median debt/equity ratio is 3.2, and debt/assets is 0.4, indicating a leveraged but manageable balance sheet.

Over the past 10 years, FedEx has demonstrated resilience and growth, with revenue increasing at a 6.8% CAGR and EPS at an 18.7% CAGR, driven by its leadership in global logistics and e-commerce delivery. Operating profits grew to $6.298 billion in 2024, with margins improving to 7.2%, reflecting operational efficiency. The company has consistently raised dividends (15.7% CAGR), and its P/E ratio of 14.9 suggests a stable valuation. Robust FCF growth (15.7% CAGR) and a manageable debt profile (debt/equity 3.2) support its financial flexibility. FedEx’s competitive advantages include its extensive global network, diversified services (Express, Ground, Freight), and adaptability to e-commerce trends. However, recent revenue declines (-2.7% in 2024) and EPS volatility indicate challenges from market saturation and economic headwinds, which may require strategic adjustments as of June 2025.

(Some of the above is taken from Grok.)

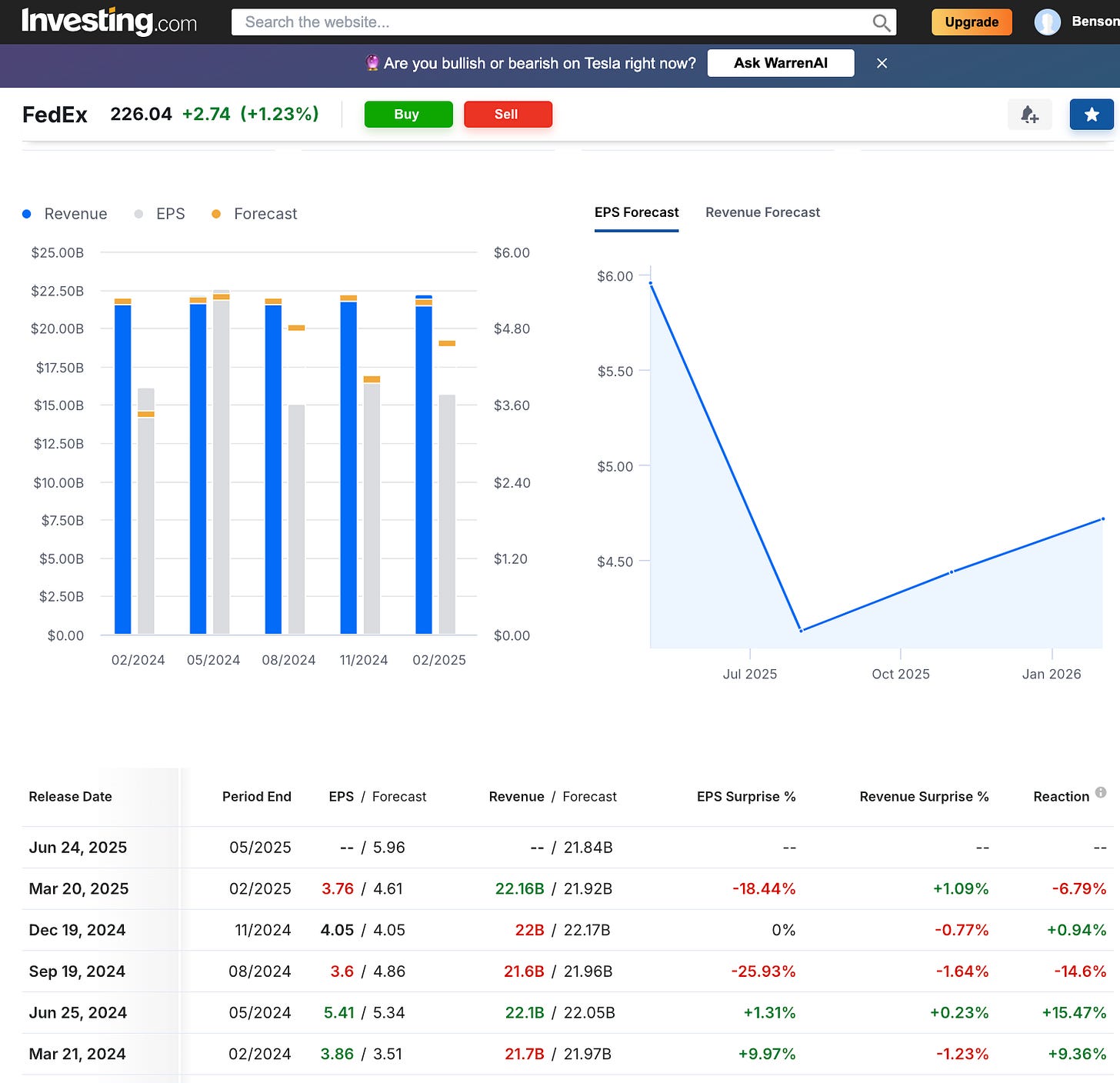

For the coming earnings, the EPS and Revenue forecast are $5.96 and $21.84 B.

FedEx has yet to make significant improvements to its top line, but has improved its profitability. Does this reflect the greater supply chain demand that is a result of the demand for goods and services?

Given the above considerations, FedEx can be an attractive option. Let us research before adding to our portfolio.

Market Outlook of S&P500 (23Jun25)

Technical observations:

MACD - a top crossover is completed, and this suggests a downtrend is coming. Ranging sideways can be a possible scenario, too.

Exponential Moving Averages (EMA) lines are showing an uptrend. However, the 3 lines are converging, and a reversal to the downtrend is coming.

Both the 50 MA line and the 200 MA line are showing an uptrend. This speaks of a bullish outlook for both the short and long term.

The CMF is positive at 0.07, indicating more buying pressure over the past 20 periods.

The daily interval is showing a “Buy" rating for the S&P 500 index.

12 indicators show a “Buy” rating, and 5 indicators show a “Sell” rating.

Here are the recent candlestick patterns.

Outlook and Implications (from Grok)

Short-Term Outlook: The emerging Evening Star and Bearish Engulfing patterns suggest a bearish short-term trend, with the S&P 500 likely to continue correcting. A break below 5,796.34 with high volume could accelerate the decline toward 5,629.83 (50 MA).

Long-Term Outlook: The long-term trend is at a crossroads. The recent high and the current drop indicate a potential reversal. If the price holds above the 200 MA, the bullish trend could resume; otherwise, a deeper correction towards is possible.

Actionable Insight: The bearish candlestick patterns suggest a short-term sell-off or consolidation. Traders should watch for a test of support at 5,796.34; a bounce from this level could signal a resumption of the uptrend, while a break below it with high volume may confirm a bearish shift. Monitor volume and MACD (which showed divergence on June 2) for confirmation of the next move.

The candlestick patterns indicate a shift to a bearish short-term outlook, with the longer-term trend at risk of turning neutral or bearish unless key support levels hold. The S&P 500 appears to be entering a correction phase following its recent peak.

From the technical analysis and candlestick patterns, I expect the market to decline in the coming days. The S&P 500 can range sideways.

News and my thoughts from last week (23Jun25)

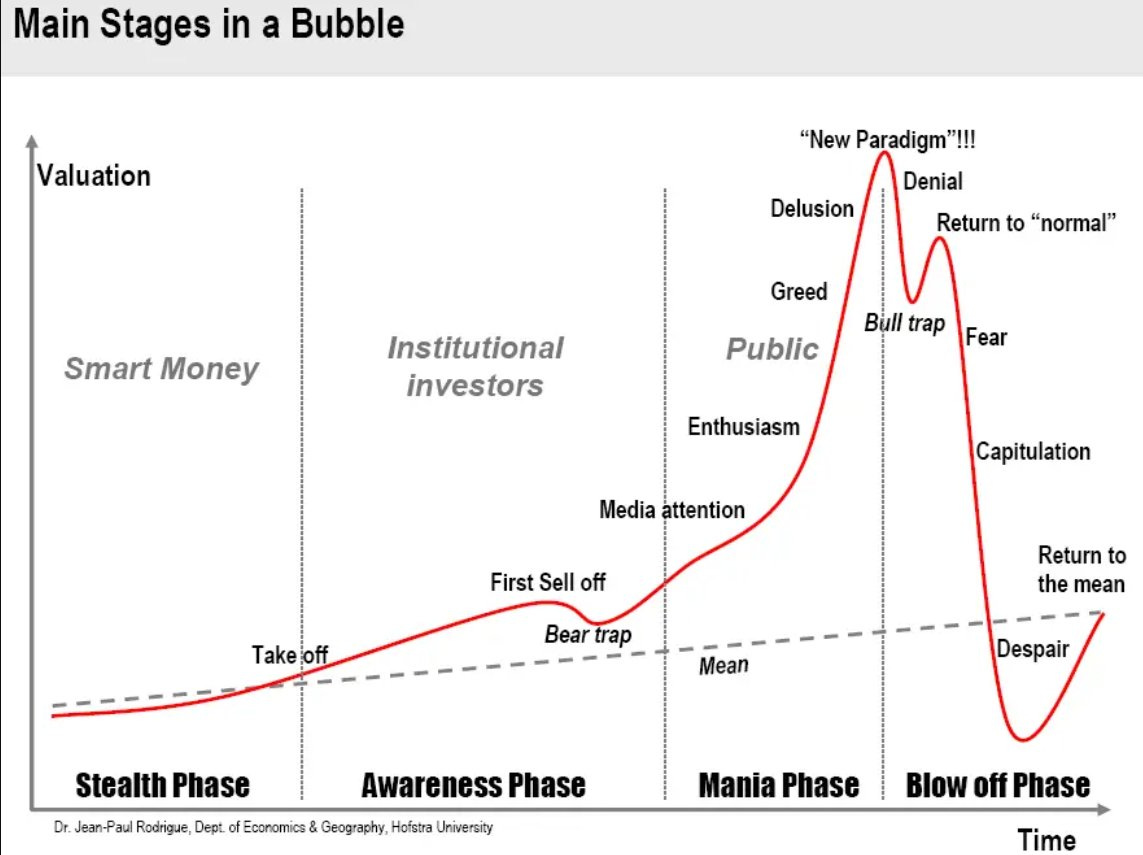

US households, mutual funds, pension funds, and foreign investors' financial allocation to stocks hit a RECORD 53%. This is larger than at the Dot-Com Bubble peak of 51%. - X user Global Markets Investor

US household net worth dropped by -$1.6 TRILLION in Q1 2025, to $169 trillion, the lowest since Q2 2024. This was the largest quarterly decrease since Q3 2022, according to Fed data. The drop was primarily driven by a -$2.3 trillion loss in the value of household equity holdings. Real estate values also declined by -$200 billion, marking the 3rd consecutive quarterly drop. However, this quarter, equity markets have rebounded and recovered a significant portion of these losses. US household wealth is highly exposed to the stock market. - X user The Kobeissi Letter

"I don't trust OpenAI and Sam Altman. I don't think we want to have the most powerful AI in the world controlled by someone who is not trustworthy," - Elon Musk.

Japanese insurers' unrealised LOSSES are HUGE: The biggest insurers’ paper losses on their domestic bond holdings hit a record ¥8.5 TRILLION ($60B) in Q1. Nippon Life, largest insurer and the world’s 6th-largest saw ¥3.6TN ($25B) LOSS. - X user Global Markets Investor

US household debt jumped $167 billion, to a record $18.2 TRILLION in Q1 2025. Household debt has surged by a MASSIVE $7 TRILLION over the last 12 years. In Q1, mortgage debt rose $199 billion to a record $12.8 trillion Student debt also hit record. - X user Global Markets Investor

Q1/25 saw a $46.8B jump in commercial and multifamily mortgage debt, nudging the total to an all-time high of $4.81T, according to the MBA. Multifamily debt alone now stands at $2.16T, up 0.9% from the previous quarter. - CRE Daily

39% of people say financial limitations prevented them from having a child - BBC

CEOs are anticipating a recession in the US: 83% of 133 surveyed CEOs expect a recession over the next 12-18 months, in line with 2022 levels. 12% expect a deep US recession with material global spillover. Are massive layoffs coming in the US? - X user Global Markets Investor

Middle East tension is distracting everyone from the fact that we have 0 trade deals and likely not even close to one (except for UK).

My Investing Muse (23Jun25)

Layoffs & Closure news

Government jobs are falling: 22,000 federal government jobs were lost in May, the most in at least 4 years. This marks the 4th consecutive monthly decline. Year-to-date, federal government jobs have declined by 59,000, to 2.96 million, the lowest since November 2024. By comparison, the 2015-2019 average was ~2.80 million. According to Reuters estimates, over 260,000 federal workers have been fired, taken buyouts, or retired early this year. The federal workforce is shrinking. - X user The Kobeissi Letter

US job numbers have been revised down by a massive 219,000 so far in 2025. April -30,000 March -108,000 February -49,000 January -32,000 22 out of the last 28 months have been revised down since the beginning of 2023. - X user Global Markets Investor

Microsoft Plans to Cut Thousands More Employees Company’s layoffs are expected around the start of July and will target sales, other departments - WSJ

Layoff wave hits freight sector as nearly 9,000 jobs are slashed. Job cuts hit workers in trucking, warehousing, food suppliers, and manufacturing - Freightwaves

Intel will outsource marketing to Accenture and AI, laying off many of its workers - Oregon Live

The above are some news items about layoffs and closures. As tariff negotiations drag on, the collateral to businesses (especially smaller ones) can compound.

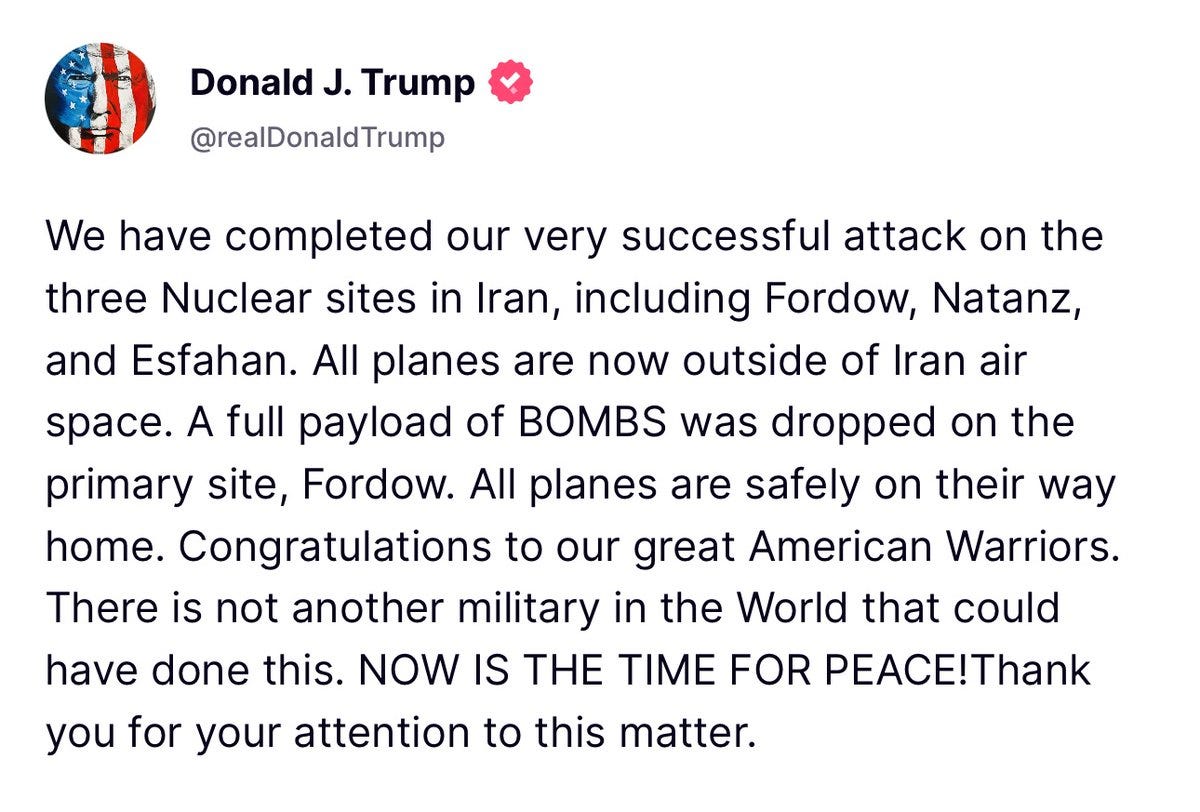

The US attacked Iran

Here are some news snippets about the US’s attack on Iran.

The New York Times says the US has now officially entered a war with Iran.

A president can be impeached for ordering a military strike without congressional approval, as it may violate Congress's war powers under Article I, Section 8, and the War Powers Resolution of 1973, which requires congressional notification and authorization. Such an action could be deemed a "high crime or misdemeanor" if Congress views it as an abuse of power. However, historical precedents like Reagan's 1986 Libya strikes show presidents acting unilaterally without impeachment. The 2025 Iran strike sparked debate, but political will, especially with GOP support, makes impeachment unlikely. It’s possible but hinges on Congress's interpretation and political dynamics. - Grok

My final thoughts

Is this the start of World War 3 (WW3) or the avoidance of one? What kind of retaliation could be expected? What dangers are America exposed to? Or will this lead to the downfall of the Iranian regime?

Iran has threatened to block the Straits of Hormuz, and there would be some supply chain disruptions coming. Vessels would have to sail past the Cape of Good Hope (South Africa) instead of the Red Sea, incurring longer lead time and costs. Logistics costs could surge, and we can expect inflationary pressures to follow.

Where do you think that we are right now? Personally, it is not about where we are. Can we consider having a portfolio that is capable of profiting from both bull and bear runs?

War brings uncertainty, and uncertainty gives inflationary pressures.

The US money printing machine has started to work again. This is likely to lead subsequent devaluation of the US dollar.

Let us review our expenditures, income, and savings. Let us spend within our means, invest with what we can afford to lose, and avoid leverage. I am reviewing my holdings and plan to cut losses with businesses losing their competitive advantages. I would also consider hedging and adding some defensive positions.

Let us do our due diligence before we take up any positions. Let us have a successful week ahead.