The latest CPI has been revealed on 12 Jan 2023.

Official news release about Consumer Price Index (CPI):

Source: https://www.bls.gov/news.release/cpi.nr0.htm

The above is the summary from the Bureau of Labor Statistics.

In December 2022, inflation fell 0.1% from November 2022 (which is better than the forecast). The YoY change fell from 7.1% (the previous month) to 6.5% as of December 2022 (as per forecast).

This implies that inflation remains heightened at 6.5%. With the initial jobless claims at 205K compared to the expected 215K, unemployment looks healthy whereas inflation remains stubborn.

Source: https://www.cnbc.com/2023/01/12/heres-the-inflation-breakdown-for-december-2022-in-one-chart.html

Observations from the update:

Inflation of 6.5% YoY remains heightened and it is way above the Fed’s “ideal” inflation rate of 2%.

Food inflation remains at a high of 10.4% YoY.

Eggs have reached an inflation rate of 59.9% YoY

Butter and margarine have a YoY inflation rate of 35.3%

Energy inflation is reported at 7.4% YoY. Energy services that include electricity and piped-in gas utility remain at a high of 15.6% YoY.

The shelter has risen 7.5% YoY

Public transportation has increased YoY by 18.9%

Source: https://www.cnbc.com/2023/01/10/americans-lean-heavily-on-credit-cards-amid-inflation.html?&qsearchterm=credit%20card

As per the CNBC news screenshot above, 46% of credit card users now carry debt from month to month and 63% are living paycheck to paycheck. (Source: https://www.cnbc.com/2022/12/15/amid-high-inflation-63percent-of-americans-are-living-paycheck-to-paycheck.html)

Implications

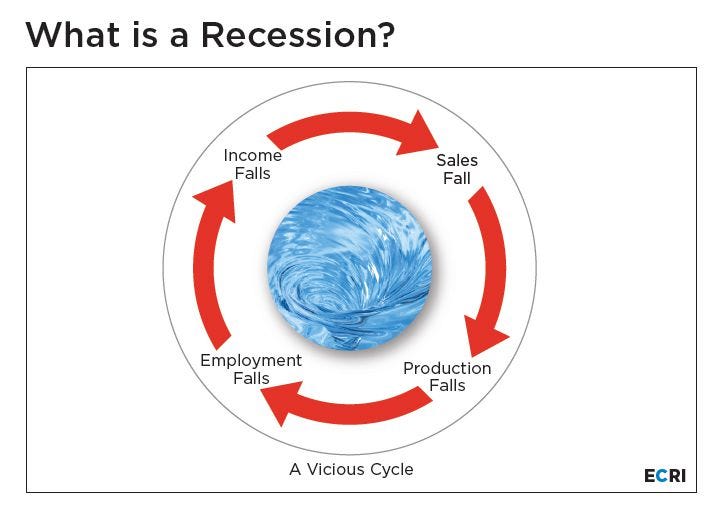

With the recession expected to hit in 2023, we should expect the following impacts from the recession cycle:

Income falls would lead to falling sales. The falling sales lead to falling production. The falling production leads to falling employment which means more people will be laid off. This will cycle back to further income falls as people lose their jobs. This is a vicious cycle where we can expect businesses to fold, stock markets to melt down and people to go through great hardships.

Out of desperation, some may turn to crime. Some will be forced to sell off assets that include the homes they live in. Some may be able to downgrade but some will be left on the street. The banks would be hit with defaults from both private and commercial customers. While we can expect them to gain from a “higher” interest rates environment, some of the banks can go under due to defaults and bad debts. This will have global repercussions. Civil unrest, violence & crimes would follow and we may even see the collapse of existing governmental regimes and the rise of new ones. In essence, we can expect there to be “blood in the streets”.

Under this backdrop of chaos, those who have cash on hand can stand to gain the most when great companies are available at good discounts (margin of safety). There is a time to buy and a time to save. For this season, saving (and not trading) can be a wise call. There would be some rallies but in a bearish environment, the magnitude of the decline is usually greater than that of a rally.

Let us spend within our means, avoid leverage, invest with what we can afford to lose and set aside “cash for crash”. Now is the time to research and shortlist great companies. Companies that do not make money are likely to go under. Companies without debts are likely to survive. Companies with competitive advantages are likely to recover faster than the competition.

Let us not forget the vulnerable, weak and vulnerable amongst us. If we can afford to share our time, talents and resources (money & materials), let us continue to do our part for charity.

The biggest wealth transfer starts in the bear market. Happy shopping when the time comes. For now, let us consider saving and tightening our expenditures.